Posture+ Specialty Cyber Insurance Broker

How you can save by implementing quality cybersecurity solutions

Current market:

Cyber insurance has been in a hard market for a number of years thanks to increased digitization in lieu of the

pandemic and the evolution of the cyber threat landscape. The evolution and spike of ransomware attacks has caused

prices to skyrocket due to a massive amount of claims being reported. The market has finally begun to settle, now is the right time to buy.

In the long run:

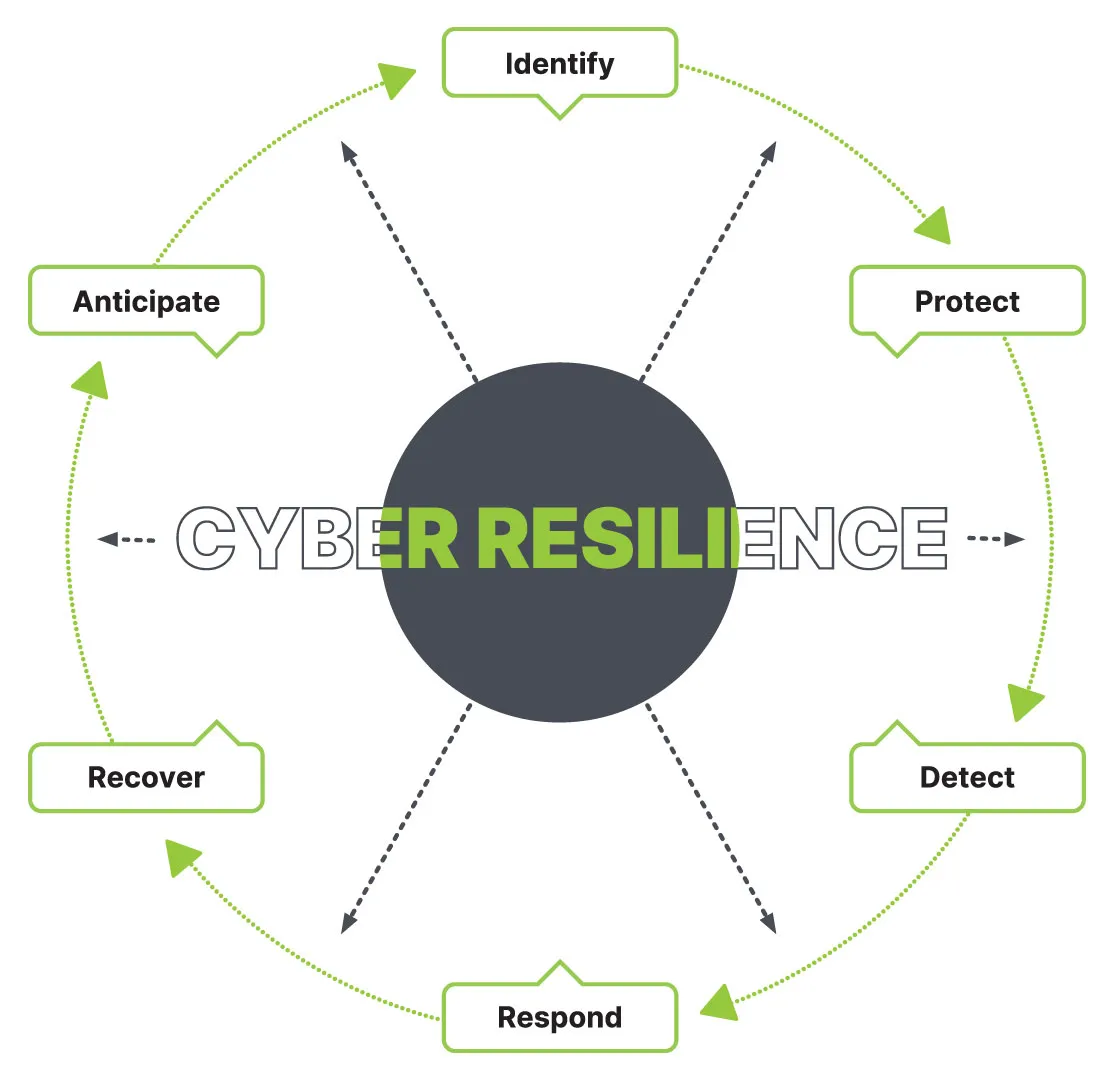

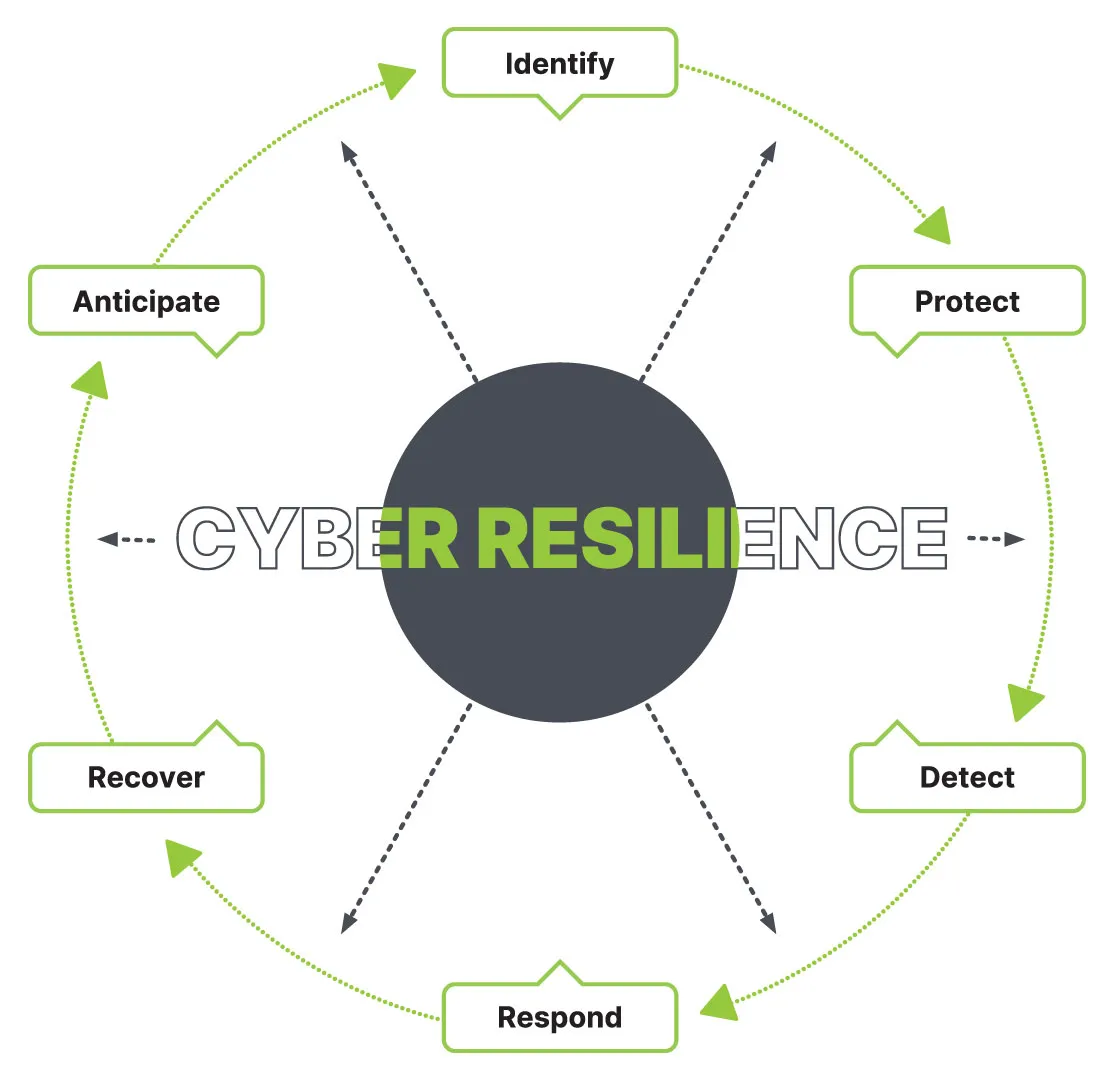

Quality cyber insurance coverage and resilience provide critical financial protection by covering costs associated with data breaches, such as notification,

legal fees, and potential fines, as well as compensating for business interruptions due to cyber incidents. This coverage ensures access to cybersecurity experts

for effective incident response and recovery, and it encourages the implementation of robust cybersecurity measures. In the long run, such insurance helps maintain

customer trust and protect the company’s reputation by ensuring swift and professional handling of breaches. Additionally, it aids in meeting legal and regulatory

requirements, ultimately supporting sustained business stability and growth.

Lower Costs:

Implementing strong security measures not only safeguards your organization's digital assets but also enhances its

cyber insurability. By investing in robust cybersecurity practices such as multi-factor authentication, encryption,

regular security assessments, and employee training, you mitigate the risk of cyber threats and demonstrate a

commitment to protecting sensitive information. Insurers view organizations with strong security postures as lower-risk

entities, resulting in potentially lower insurance premiums and more favorable terms.